What We Offer

We are investors with deep insurance expertise allowing us to:

Write 100% fronted programs

Allowing you to focus on your vision while having the ability to access markets with a Company with an AM Best rating of A-.

Assume risks through quota share programs

Growing too fast and need to off load some risk? We take a unique approach in assumption reinsurance one that allows you to continue to grow while also providing surplus relief.

Partnering

Through direct equity investment or debt with start-up or expansionary companies in the insurance space. We take an innovative and simple approach in partnering so the founders can focus on realizing their visions.

Management

Cory Moulton

Chairman

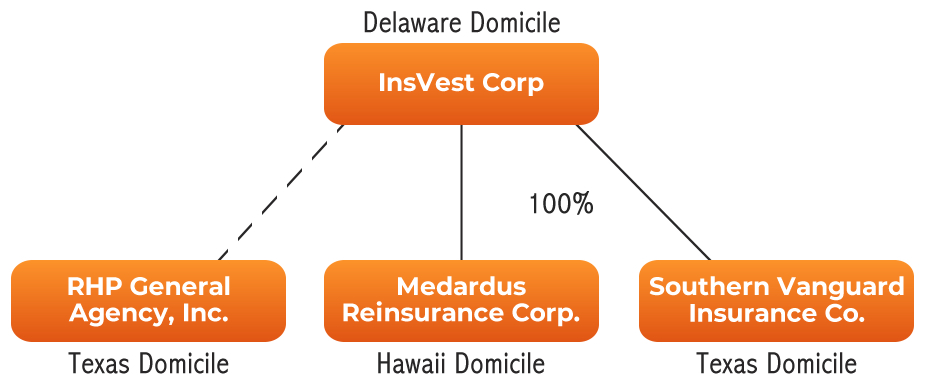

Cory Moulton was the lead investor in the 2014 acquisition of RHP General Agency, Inc. and Southern Vanguard Ins. Co. and currently serves as the Chairman of both companies. He formed Omena Partners, LLC in 2011 as a vehicle to advise for and invest in select insurance industry opportunities. Mr. Moulton has an extensive background with over 25 years of experience in the global reinsurance and specialty primary insurance industry.

From April 2005 through March 2011, he served in various senior management roles with HCC Insurance Holdings, Inc. ("HCC"), including Chief Executive Officer of PIA, Inc. and Executive Vice President of U.S. Property and Casualty. HCC is a NYSE-listed specialty insurer with approximately $3.5 billion of shareholders' equity, an approximately $4.5 billion market capitalization and $2.8 billion of annual gross written premiums.

Prior to HCC, Mr. Moulton co-founded Tobat Capital Partners, a venture fund which raised and invested more than $70 million in early stage technology companies focused on the financial services sector. Mr. Moulton began his career with E.W. Blanch Holdings, where he served in roles ranging from new account production executive to President of the London based E.W. Blanch International.

Sofia Gil

AVP of Regulation and Compliance

Sofia Gil graduated from Boston College with a Bachelor of Arts in Political Science and History. Sofia joined RHP General Agency in 2017 as a staff examiner in the Claims Department and obtained her license in Property and Casualty Adjusting. She later transitioned to a role managing the day-to-day operations of an affiliated adjusting company, focused on ensuring the quality and timely conclusion of claims.

In 2020, Sofia became the AVP of Risk and Compliance for Southern Vanguard Insurance Company. Sofia is primarily responsible for the statutory and regulatory compliance of the organization.

Felecie Medellin

Director of Claims

Felecie Medellin joined Southern Vanguard Insurance Company (SVIC) as Director of Claims in 2024, bringing with her over 20 years of experience in the Property and Casualty insurance industry. Prior to her role at SVIC, she served as Director of Claims at RHP General Agency from December 2008 to 2024.

Ms. Medellin’s career in insurance began in 2006 when she obtained her General Lines Agent License. She further expanded her expertise by acquiring her Property and Casualty Adjusting license in 2007. Throughout her tenure at RHP, Ms. Medellin oversaw the claims department, ensuring adherence to company procedures and efficiently managing the handling of all claims.

Her extensive experience working with independent agencies and various insurance carriers over the years has equipped Ms. Medellin with a comprehensive understanding of the industry. This wealth of knowledge and expertise now benefits SVIC, where she continues to excel in her role as Director of Claims, leveraging her skills to enhance the company's claims management processes.